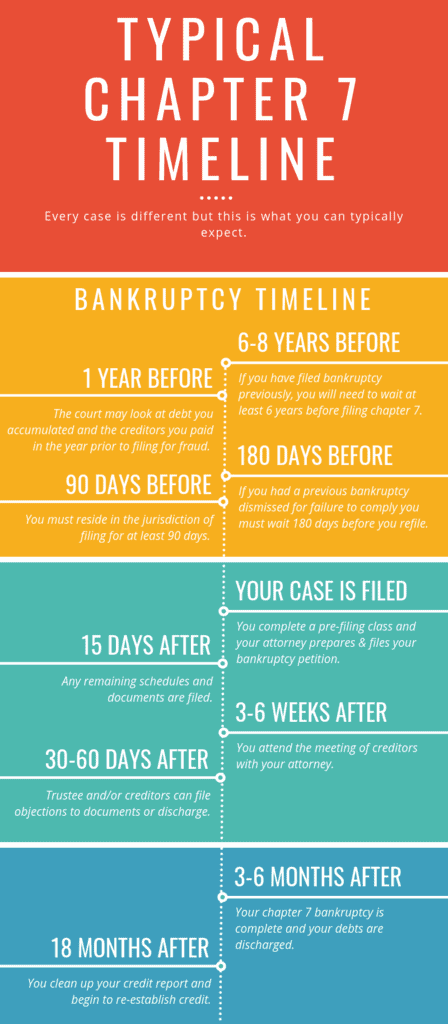

How Long Does Filing Chapter 7 Take?

With mounting debt and the incessant calls from collectors, you should not delay sorting out your financial troubles. You might even consider filing for Chapter 7 bankruptcy. However, the most important concern for many is the Chapter 7 bankruptcy timeline.

A Chapter 7 bankruptcy case typically takes 3-6 months to complete. It is faster than Chapter 13 bankruptcy and therefore allows you a quick, fresh start.

However, you need to know of the dates that have an impact on your right to file a case. You may refer to the Chapter 7 bankruptcy timeline below for the critical dates to consider when filing bankruptcy.

6-8 Years Before Your Bankruptcy

You are eligible for Chapter 7 discharge if you received a previous discharge in Chapter 13 or Chapter 12. The former case filing took place within the previous six years. Additionally, you paid at least 70 percent of your allowed unsecured claims, in compliance to a repayment plan proposed in good faith.

You’re not qualified for a Chapter 7 discharge until eight years from the date you filed a prior Chapter 7.

1 Year Before Your Bankruptcy

The court may deny a Chapter 7 discharge and allow the creditors to recover the transferred property. This can happen if there was an intent to delay or defraud your creditors. The court examines if you transferred, hid, or destroyed property within the 1-year period prior to your bankruptcy.

The court may recover all payments to creditors who were given preferential treatment. This also applies to the 1-year period prior to the filing of your bankruptcy case.

Also, the Automatic Stay entered in the Chapter 7 case will be terminated within 30 days. It will be extended by demonstrating that your Chapter 7 case was filed in good faith.

180 Days Before Your Bankruptcy

You’re not allowed to file for bankruptcy again within 180 days if your previous case was dismissed by the court. There is also a 180-day waiting period if you voluntarily dismissed your previous case.

You must also receive an individual or group briefing from an approved nonprofit budget and credit counseling agency. This must happen within the 180 days before filing for bankruptcy.

90 Days Before Your Bankruptcy

You must reside in the state where you plan to file your bankruptcy case for at least 90 days. If you have not resided in the state in which you plan to file your case for at least 90 days, you may only file your case in the state where you have lived in, or which has been the area of your principal assets, for a majority of the previous 180 days.

As previously stated, the court can recover payments to creditors found to be given preferential treatment. As such, the court can go back any time within the 90-day period prior to the filing of your bankruptcy case.

The court will find certain debt to be non-dischargeable. This can include debt of $500 or more for “luxury goods or services” within the 90-day period before your bankruptcy. It can also include cash advances amounting to $750 within a 70-day period prior to filing bankruptcy.

Filing Your Case!

When you file your personal bankruptcy petition with the bankruptcy court, your case has formally commenced. As soon as you file your petition, the court will enter an Automatic Stay order. The Automatic Stay forbids creditors from proceeding with any kind of collection or legal action against you. This means you are free from bothering letters or calls for as long as the Automatic Stay is in effect. It is typically lasts throughout the duration of your bankruptcy case.

Next, the court will send a notification of your case to every one of the lenders noted in your petition.

Furthermore, the bankruptcy court will assign a bankruptcy trustee to supervise your case. The trustee is a federal employee. His or her job is to monitor your case and to ensure that you are eligible for bankruptcy. The trustee will examine your case, confirm that it is complete, and afterward set up a meeting of your creditors.

15 Days After Filing

You have a deadline of 15 days after you file your petition to file specific financial “schedules” with the court. These documents proclaim your assets, liabilities, expenditures, earnings, as well as a statement of your affairs. Typically, your bankruptcy lawyer will submit these schedules with your petition.

Approximately 15 Days After Filing

Within approximately 15 days after filing, the court will send out the Notice of Commencement of Case to you. All of the creditors listed in your petition will also receive this Notification. This notice will state the date set by the court for the meeting of your creditors. It also includes deadlines for your creditors to object to your case and file their claims against you.

Approximately 30 Days After Filing

You must file a Statement of Intention within 30 days after you file your case. Or, it must be filed before the meeting of your creditors. It depends on which comes first. This document informs the court if you plan to retain your property that serves as collateral for your debts. Or on the other hand, you intend to relinquish it to your creditors.

If you intend to keep the property, you must state your intention to:

- Reaffirm your debts and continue making all of your payments on those debts;

- Reclaim the property by paying the fair market value for it. In this case, you will receive a discharge of debt owed over the fair market value of the item.

You must provide a copy of your Statement of Intention to the trustee and creditors when you file it with the court.

45 days After Your Statement of Intention Filing

You have 45 days after your Statement of Intention is filed to retain or surrender your property and make all necessary payments as indicated in your Statement.

Approximately 3 to 6 Weeks After Filing

The court will hold the Meeting of Your Creditors about three to six weeks after your bankruptcy case is filed. You have to provide a copy of your most recent tax return to the trustee and any creditor requesting it. This must happen at least seven days before the meeting.

This meeting will be presided over by the court-appointed trustee and you are required to attend. The trustee will ask you questions about your debts and the statements in your petition. You will be under oath and in front of your creditors. The meeting is very informal and will not take more than 10 minutes. However, bear in mind that, if you do not attend the meeting, your case will be dismissed.

Within 45 days after you file your petition, you are required to file a statement containing:

- A certificate from your attorney where you received an explanation of the various chapters available under the bankruptcy code.

- Evidence of any payments you have actually obtained from any employer within 60 days of your filing.

- An itemized declaration of your monthly earnings.

- An estimate of any type of increase in income or expenses you expect over the next 12 months.

30 Days After The Meeting of Your Creditors

The trustee and creditors have 30 days after the conclusion of the Meeting of Creditors to object to your exemptions.

60 Days After The Meeting of Your Creditors

Your creditors have 60 days from the date of the meeting to object to the discharge of any of the debts detailed in your petition and schedules.

Your creditors can object if the debt was incurred due to any of the following types of misconduct: fraud; embezzlement or larceny; and any willful or malicious injuries you have caused others; or a divorce or separation (excluding debts for child support and spousal maintenance, both of which are non-dischargeable by law).

Furthermore, your creditors can challenge your petition to the discharge of all your debts if you have engaged in any of the following conduct:

- concealment or destruction of property or financial records

- false statements

- withholding information

- failing to explain losses

- failure to respond to material questions

- a discharge in a prior Chapter 12 or 13 case filed within the previous 6 years or a Chapter 7 case filed within the previous 8 years

If the trustee discovers that the granting of relief would be an abuse of the provisions of Chapter 7, he must move to dismiss your case within this time period. You will receive your Chapter 7 discharge 60 days after the meeting of your creditors. You will receive your discharge as soon as the 60-day prescriptive period for objecting to discharge or moving to dismiss your case expires. However, even if you receive your discharge, the trustee may move to set it aside if you do not turn over nonexempt property or if you commit other bankruptcy violations.

The Bankruptcy Abuse Prevention and Consumer Protection Act of 2005 imposes one last hurdle. The Act requires you to finish an instructional course about personal financial management.

90 Days After The Meeting of Your Creditors

If your creditors (excluding government entities) want to receive payments from your case after your assets have been liquidated, they should submit their proofs of claim (these are documents your creditors submit to the court stating how much you owe them) within 90 days after the first date set for your creditor meeting.

On the other hand, government entities (such as the IRS) have 180 days after the filing of your case to submit their proofs of claim.

If you are fed up with the incessant calls from collectors and the stress of dealing with your creditors, bankruptcy may be the solution to take back your peace of mind.

A well-versed bankruptcy attorney will provide you with the best options after a thorough analysis of your circumstances. You will also be enlightened on the nuances of the Chapter 7 bankruptcy timeline. Free your mind of worry and confusion. Contact our skilled bankruptcy lawyers now.