Chapter 7 Bankruptcy: What Happens at the Meeting of Creditors?

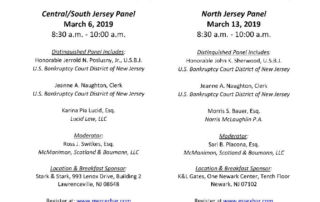

You have filled out your bankruptcy paperwork, provided all the necessary documentation, and we have filed your petition for relief. Now, it’s time to get ready for the meeting of creditors. This meeting is also known as a 341 Meeting or the Meeting of Creditors. During this meeting, the trustee overseeing your bankruptcy case will ask a list of questions. [...]